Knowing which section of your NHS pension scheme you are a member of is important; 1995, 2008 or the 2015 NHS pension section? Depending on which pension section you are a member of determines the rate at which you accrue benefits, your normal retirement age and in light of the recent ‘McCloud Remedy’ could give you some important choices in the future.

With so many adjustments to the NHS Pension scheme and pension legislation, you can hardly be blamed for glazing over when you attempt to make head or tail of the plethora of information. Recent research* has shown that 75% of GPs are unaware of the annual and lifetime allowance limits on their pension savings. Possibly more alarmingly, the same research showed that 31% didn’t know which section of the NHS Pensions scheme they were members of.

This lack of knowledge is not limited to just your colleagues in General Practice!

NHS pension reforms that could affect you

In the 2020 spring budget, the government increased the earnings limit as to when you start to experience tapering of your annual allowance, from £110,000 to £200,000. This was in response to the issue of so many pension members hitting and exceeding the annual allowance limit, often due to their allowance being tapered due to ‘high earnings’.

Unfortunately, this increase didn’t fully get to the root of the problem as it is still possible to exceed the full, untapered £40,000 annual allowance and land yourself with an additional tax bill in return for taking on extra duties, getting a pay increase, award or other previously sought after career markers.

Annual Allowance Charge Compensation Scheme

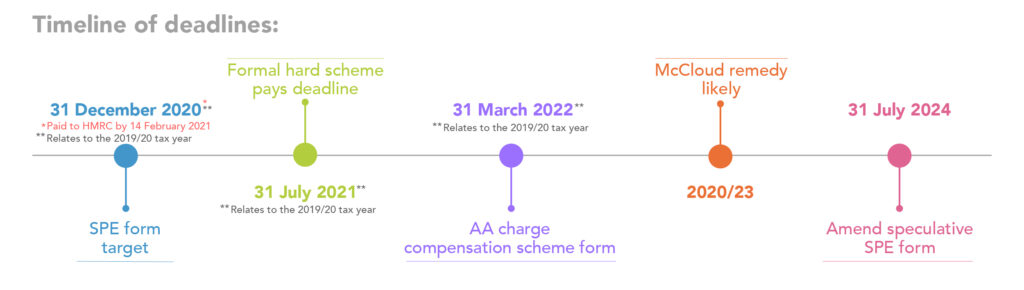

The government has now introduced the Annual Allowance Charge Compensation Scheme, where the scheme pays any additional charge and your pension benefits will not be reduced to repay this at retirement.

We will see how far this goes to help ease the pain! But once again the onus is on the individual to realise there’s an annual allowance problem, get it calculated and then complete the necessary paperwork to secure the compensation by the set deadline. Not exactly easy or worry-free.

Believe me, it’s complex and not to be tackled unless you’re very confident in the process. This is when we come in handy – we can help with that!

This is already complicated enough, I hear you cry! But then along came the age-discrimination legal challenge – The McCloud Remedy.

Will the McCloud Remedy affect you?

Although the ramifications of the age-discrimination legal challenge are not fully settled, it could mean that some NHS pension members will see their annual allowance input and associated tax charges change retrospectively. It could also mean that some members choose to move back into the old heritage sections of the NHS Pension scheme.

This will be especially meaningful for members working less than full time, as the new 2015 scheme uses a career average earnings method of setting income used for the basis of pension calculations, while some of the heritage schemes use best of the last 3 years, and accrual rates differ in all 3 schemes.

If you are working on a less than full-time basis you could benefit from a greater pension in retirement under the old schemes. But nothing is certain as yet. This is yet another complex issue and it will take some time to fully understand the fall out for members.

The same research I mentioned earlier found under 7% of GPs surveyed do not understand the McCloud Remedy impact on their own personal situation. I’m not surprised! With ‘Covid work-life’ as it is, family life, home-schooling and your own ‘normal’ life to keep on top of – I’m amazed any of you are even trying!

Here at Legal & Medical, we work every day advising members on the NHS pension scheme and are carrying out in-depth analysis as information is rolled out. Thankfully the BMA are lobbying hard for the age discrimination remedy to be tailored to all doctors, full-time or part-time. But the ‘remedy’ itself is far from clear at this time. So, I’m afraid I’m saying it’s another case of ‘watch this space’ and don’t hesitate to speak with us if you aren’t sure if any of this applies to you.

Personally, I would like to see a full overhaul of the pension regulations. However, I have been specialising in this area for too many years to believe that’s something we can really expect any time soon!

So, in the absence of a magic wand to simplify all these changes, keep informed and keep taking the best advice you can from specialists like ourselves.

* Research carried out by Wesyelan Dec 2020.

Have you checked if you have breached your annual allowance? Let us know by adding a comment below.