For many doctors and dentists navigating the NHS pension scheme (NHSPS) can seem like a bridge too far on top of actually working within the NHS. Over the last decade, there have been some major changes to the NHS pension scheme, with the proposed changes to the flexible retirement rules being the latest of a long list.

To reassure you, few medical professionals even attempt to master the pension scheme until there is a problem to overcome. It’s amazing how motivating an eye-watering tax bill can be, and receiving your annual allowance statement can trigger a state of panic in even some of the most financially astute medics.

There are many scenarios where you could need a little help and guidance – Do any of these concerns sound familiar?

- I need to check my previous annual allowance figures as I am not sure they are correct.

- I am concerned about my future annual allowance position.

- I have or will breach the lifetime allowance – what should I do?

- I have other pensions, so in which order should I draw them? Before or after my NHS pension?

- What is the actual impact of the car salary sacrifice?

- What are my pension options, and should I consider alternative strategies?

- What impact will the McCloud Judgement have on my pension?

Legal & Medical Investments deal with NHS pensions every day and study the changes in detail as they are released. Periodically, reviewing your pension is vital, as John F. Kennedy once said “In a time of turbulence and change, it is more true than ever that knowledge is power.”

Professional help is at hand

Fear not! We can help. We offer an NHS pension modelling report in conjunction with MediFintech providing information allowing you to make informed decisions.

The report is a comprehensive assessment of your NHSPS situation both current and past, and will offer a forecast of future benefits and potential pension taxation considerations.

The report gives you an assessment of your personal pension taxation for your annual allowance (including any tapered annual allowance, if applicable) and your potential standing against the pensions lifetime allowance (LTA).

Great, how do I make a start?

Firstly, you need to gather your data together in order for the report to be compiled.

Step 1

In the first instance, we recommend you contact the pensions agency to ascertain your annual allowance and service extract. You can request this from the pension’s agency on 03003 301 346.

This information will detail your pension growth each year and your service history. Check your service history for any breaks listed that shouldn’t be there, i.e., a missed rotation. Unlike most information from the NHSPS this process is usually quick and easy to obtain.

Step 2

We require payslips, the most recent one and the previous March. If you are a GP, then it will be your tax computation. Ideally, to offer maximum accuracy we like to see March payslips going back to March 2016. We appreciate this might be a stretch for some!

Step 3

Total income details. If you have no other income, then payslips will be enough, but if you have a private medical practice or other sources of income, i.e., dividends or a rental income, we need details of those income sources too. These additional incomes are used in calculations to see if you have crossed a threshold where we would see your annual allowance reduced. Threshold income rules were introduced in April 2016, so if your income was in excess of £110,000 for the 2016/17 tax year onwards until the 2020/21 tax year when it was raised to £200,000 and currently remains at this level (Feb 2023), then accurate data is required. This will normally be your tax calculations, which were formerly SA302’s.

The calculations for income are not straightforward, certain aspects can be removed and others added in. If you have a clear blue sky between your income and the threshold, you may not need to worry. If you are close, unsure, or simply want absolute peace of mind, then it’s worth providing all your income data for checking.

Step 4

We will need your most recent total reward statement detailing your pension benefits accrued to date (accessible via your workplace online portal).

Step 5

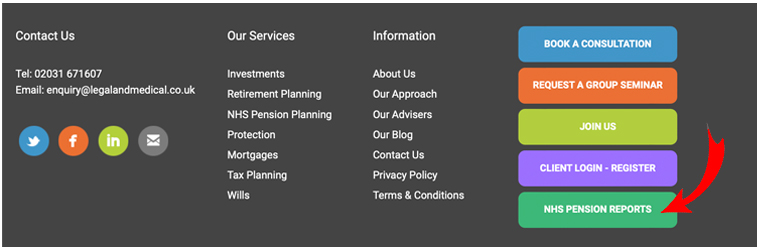

Requesting the report from us is easy. You can contact your Legal & Medical advisor or get in touch via our website at www.legalandmedical.co.uk. Just look for the green ‘NHS Pension Reports‘ button in the footer area on our website.

Step 6

There are two services offered; one involving Legal & Medical and the other speaking only to MediFintech.

If you simply wish to understand the report, then the lower-cost option is to speak directly to MediFintech. They are not financial advisers and cannot give advice, but they are excellent at talking you through the report.

If you wish to receive advice about the NHS pension scheme and your options, or generally have a more detailed discussion, including forming a strategy then it is likely you will need to involve an adviser at Legal & Medical. There is an additional cost for our service, and you would need to speak to us to ascertain the details.

We often find that once we have discussed the issues with a client, we actually need several subtly different reports to enable us to answer specific questions they have, so we can help arrange those too. Up to 5 variations are included in the initial fee.

Step 7

Arrange a meeting with your adviser to go through the report to cover all your questions. We will take you through the pension taxation issues the McCloud Remedy will create. We will also guide you through an estimation of the ‘deferred choice underpin’ at your intended retirement age to give a better understanding of potential NHSPS benefits at your intended retirement age, plus a forecast of NHSPS benefits at your planned retirement date with the potential impact of pensions lifetime allowance implications.

Our objective is to equip you with the figures you need to answer any questions regarding your NHS pension scheme, both while you are working or as you move into retirement. The report and subsequent meeting allows you to make informed decisions on how you may wish to pay any tax liability and your membership of the pension scheme. However, we will never make recommendations regarding leaving the scheme or payment of the liability, ultimately, this has to be your choice, but we will give you everything you need to make the right decision for you.

Other ways of tackling the issue

If you wish to calculate your annual allowance liability yourself (historically for your tax returns) then the HMRC provides a good basic DIY calculator. However, I would strongly advise checking the accuracy of the information you are using by verifying the data with the NHS beforehand to ensure it is without error.

If you are unsure of the suitability of the report’s please do get in touch, so we can have an initial chat to see if they are appropriate. One thing is sure, the rate of change and complication surrounding the NHS pension scheme does not seem to be abating. Rest assured Legal & Medical are always here to guide you through the maze.

NB: As part of our introduction to MediFintech they will pay a fee to Legal & Medical of £50 per report requested through us. This does not alter the fee charged to you as the client.