Month four of 2022, and much has happened since our last market update – rising inflation, spiralling energy costs, and war in Ukraine are just a few major features that affect the markets and portfolios…

Economic commentary

Inflation has hit levels not seen for many years, largely driven by the dramatic spike in energy costs which has fed into the supply chain, with a resulting impact on the cost of many goods and services.

This has, of course been exacerbated by the terrible situation in Ukraine, which has further driven up energy costs, and with it, inflation. The likelihood is that what was originally looking like a short-term spike in inflation may end up being a longer-term spike.

How do Central Banks deal with rising inflation? The only (rather blunt) tool in their inflation-reducing toolbox; by raising interest rates. Economic theory has it that by increasing interest rates and making everyone’s mortgages and other borrowings a bit more expensive, people have less disposable income in their pockets and so spend a bit less, as a result, the heat is taken out of rising prices. But of course, much of the inflation we are seeing is not caused by consumer behaviour but by the aforementioned energy and supply chain problems. Central Banks are treading a fine line!

Market commentary

Markets generally don’t like rising inflation and rising interest rates, as it costs businesses more money if they need to borrow to fund their growth. If you are a growth business that needs to borrow, or if you are a business that relies on consumers (with fewer pounds in their pockets) choosing to buy your product (e.g. luxury goods), rather than having to (food, energy etc), this has caused a bump in the road.

We previously saw a sell-off in some equity markets in the last quarter into 2022, especially, as the increasing spike in inflation – much of it driven by spiralling energy costs and the Covid impact on the supply chain has unsettled the markets. There is an expectation that interest rates will continue to be raised by central banks, albeit much of this is now ‘priced in’.

We remain hopeful, whilst it now looks likely to be longer than first expected – this inflation spike is a temporary one. It is also probable that central banks will be careful in the rate at which they tighten monetary policy as they have a fine line to tread so as not to derail the post-COVID recovery. It’s still possible that the global economy is poised for another year of growth, albeit much more modest than 2021.

The main ‘unknowns’ for 2022 are:

- The situation in Ukraine

- How long the spike in inflation lasts

- Central banks’ policies over interest rates

- The possibility of further COVID-19 lockdowns as infection rates increase again, or new variants emerge

In the short term, inflation has already reached uncomfortable levels and may indeed tick up more as and when the full effects of energy price hikes are felt domestically, although it should decline in time. Regarding COVID-19 risks, the success so far of the vaccine roll-out and more recent approval of pills to treat infections have made investors more relaxed. The recent Omicron variant does demonstrate that these risks can quickly return, though we may now be seeing evidence that infections have plateaued.

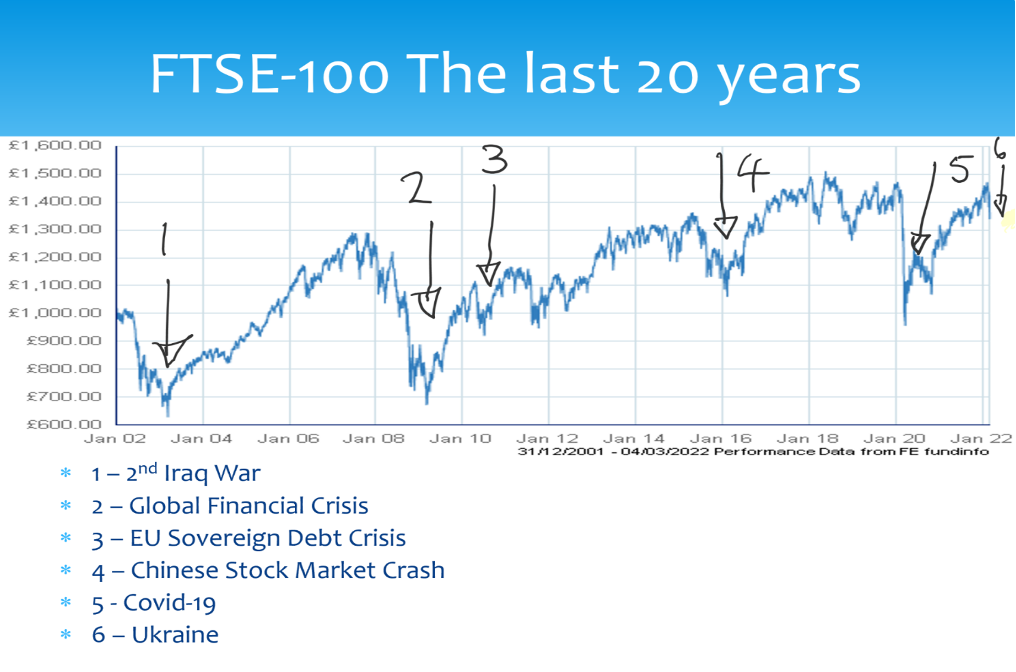

The impact of the war in Ukraine on markets has been, in the scope of previous conflicts and world events, surprisingly muted, as the FTSE-100 graph illustrates below:

Perhaps we shouldn’t be that surprised – there have been a series of events, large and small, which have impacted markets in the last 20 years. This graph illustrates the shock caused in each case – also the subsequent recovery; whilst there can be no guarantees history demonstrates that markets do recover fairly quickly following a major crisis or world event.

Portfolios overview (figures to 1.4.2022 from FE Analytics)

Across the board, performance has been strong over three years, even for the more defensive and cautious portfolios. This has been driven by conviction over-investment in a range of global equity markets where we have benefited from some of our active fund managers taking bullish positions in technology and growth-oriented stocks. During 2021 we rebalanced some of our portfolios to take an increased position in UK stocks as this sector appeared a little undervalued compared to its global peers.

More recently, the inflation threat has caused a sell-off in growth sectors, in particular, as fears over interest rate rises have fed through, with concerns over the ability of some companies to make profits at the same level. This resulted in some quite savage volatility in the early weeks of 2022 and has therefore continued to impact the shorter-term performance, which means we see some negative returns for a number of our portfolios over the last year. There has been something of a minor rebound in the last few weeks, and in many cases, there are some improvements in the 6-month and 1-year figures, but most portfolios remain below their pre-Christmas high points.

Our aims in building and running our portfolios continue to be for well-managed funds, which themselves invest in companies with sustainable earnings. It remains the case that investment is a long-term game for long-term gain.

There is no right or wrong ‘time’ to invest, and no one can predict where the peaks and troughs lie now or in the future. As the old mantra says; – it is not timing the market – but time in the market that matters.

Active Portfolios

You may need to scroll left and right if you’re viewing the table below on a small screen.

| Portfolio | 6 month performance | 1 year performance | 3 year performance | FE Risk Score |

|---|---|---|---|---|

| L&M Defensive Active | -4.14% | -0.26% | +20.67% | 33 |

| L&M Cautious Income | +1.85% | +8.57% | +15.46% | 46 |

| L&M Cautious Active | -7.2% | -1.82% | +28.34% | 48 |

| L&M Moderately Adventurous Active | -12.87% | -7.43% | +42.99% | 77 |

| L&M Adventurous Active | -13.08% | -7.37% | +47.05% | 85 |

| L&M Speculative Active | -14.93% | -12.54% | +47.56% | 101 |

Passive Portfolios

| Portfolio | 6 month performance | 1 year performance | 3 year performance | FE Risk Score |

|---|---|---|---|---|

| L&M Passive Defensive | -0.67% | +5.42% | +24.62% | 34 |

| L&M Passive Cautious | +0.53% | +9.48% | +35.55% | 49 |

| L&M Passive Moderately Adventurous | +1.02% | +10.63% | +41.91% | 64 |

Green & Positive Portfolios

| Portfolio | 6 month performance | 1 year performance | 3 year performance* | FE Risk Score |

|---|---|---|---|---|

| L&M Green & Positive Cautious | -3.58% | +2.00% | 60 | |

| L&M Green & Positive Moderately Adventurous | -4.35% | +1.53% | 73 | |

| L&M Green & Positive Adventurous | -5.55% | +0.82% | 86 | |

| L&M Green +Positive Speculative | -7.11% | -1.32% | 94 |

*3 year figures available summer 2022

Collective Portfolios

(for personally-held Investment Accounts)

| Portfolio | 6 month performance | 1 year performance | 3 year performance | FE Risk Score |

|---|---|---|---|---|

| L&M Cautious Collective | -4.45% | +1.15% | +28.65% | 47 |

| L&M Moderately Adventurous Collective | -8.93% | -3.70% | +38.34% | 65 |

Figures as at 01 April 2022

We use FE Financial Express (relative risk) scores to map out the range of investment risk for a given portfolio or funds selected.

Further information on this can be found in our “Legal & Medical Guide to Investment and Understanding Risk”. Please contact your individual Adviser, should you wish to see a copy. If you have any concerns or questions regarding your portfolio or a general stock market query, do please get in touch.