Do the words “threshold income”, “adjusted income”, “tapered allowance” & “scheme pays” sound familiar? For those clinicians who recognise this terminology we finally have some good news regarding any tax charges you may have incurred for breaching your annual allowance in 2019/20.

Medics and dentists face many complexities and challenges in calculating annual allowance tax charge liabilities. We’ve written numerous articles, and spoken to many of you about the issues you face. However, for clinicians in England & Wales, at least where the annual allowance & NHS pensions are concerned there has been a major development.

What is the good news?

Clinicians who are members of the NHS Pension Scheme (NHSPS) and face an annual allowance tax charge in respect of the tax year 2019-20 will be able to have this charge repaid by the NHSPS.

This means that affected individuals will not, and should not, have to worry about paying the tax charge out of their own pocket. To be clear, currently, this only applies to the 2019-20 tax year and to NHS clinicians in England & Wales.

To be doubly clear, if you are an “eligible clinician” and suffered an annual allowance tax charge in 2019-20, or think you may have, then please do not pay this tax out of your own pocket.

How will I know if it applies to me?

You need to be an “Eligible Clinician”, definition as follows:

- You are a member of the NHSPS in the tax year 2019/20

- You are employed or engaged in a clinical role delivering care to NHS patients that requires registration with an appropriate healthcare regulatory body.

- You have a valid registration for the period of the 2019/20 ‘Scheme Pays’ election.

- You receive a tax charge associated with breaching the annual allowance, including the tapered annual allowance in 2019/20, in respect of membership of the 1995/2008 and/or 2015 NHS pension schemes, and use ‘Scheme Pays’ election to pay the tax charge.

What do I need to do?

Assuming you are “eligible” there are four things you need to do:

- Calculate your annual allowance tax liability.

- Complete a scheme pays election form.

- Complete a 2019/20 annual allowance charge compensation policy application form.

- Complete your HMRC self-assessment.

Where do I find the forms & how do I submit them (England Only)?

The scheme pays election form is available for all via the NHS Pensions website.

The way in which you access and submit the new Compensation Policy Application Form differs depending on your role.

Medics in secondary care: This form is available via the NHS England website and the forms can be submitted via email and/or post to NHS BSA. We would suggest both:

Email: nhsbsa.pensionsmember@nhsbsa.nhs.uk

Post: NHS Pensions, PO Box 2269, Bolton, BL6 9JS

Dentists: The form will be available for completion and submission to NHS BSA online via Compass.

GP’s in Primary Care: At the time of writing, sadly the position is unclear. The exact process of how to access and submit the forms to PCSE for endorsement will be communicated by NHS England & NHS Improvement in due course.

Similarly, at the time of writing this application process has only been announced for eligible clinicians in England. Details of the Welsh application process are still being finalised for NHS Wales and we’ll share more information when it becomes available.

Are there any deadlines?

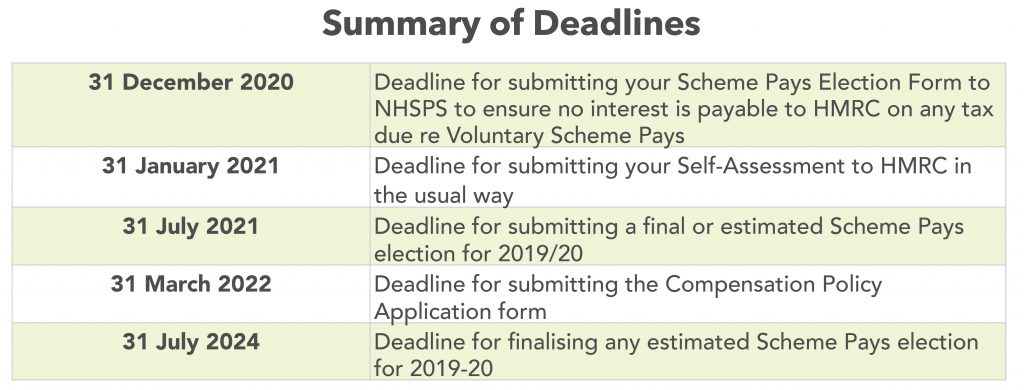

Yes! If you miss them, you will miss out on the compensation. It is your responsibility to ensure that NHS pensions have received the forms by the relevant deadlines, so here is a reminder of the key dates: You may need to scroll left and right if you’re viewing the table below on a small screen.

Summary

This is a hideously complex area! Please remember Legal & Medical Investments are here to help if you need any guidance from our team of specialist medical independent financial advisers.

Wherever annual allowance tax charges are concerned we would also recommend that you seek guidance from a specialist medical or dental accountant to work along side your specialist financial adviser.

Good luck out there!